¶ AADE MyData integration (for Greece)

- Overview

- Installation

- Initial setup

- Settings

- Configuring eInvoicing items

- Mapping of payment methods

- Logs

¶ Overview

This module was designed to help the customers from Greece synchronize invoices in Splynx with AADE myData service as per government requirements.

¶ Installation

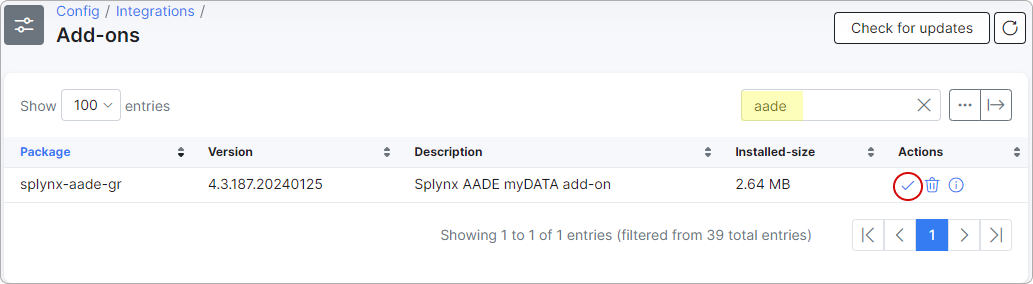

To install this module navigate to Config → Integrations → Add-ons and find splynx-aade-gr module and install it:

¶ Initial setup

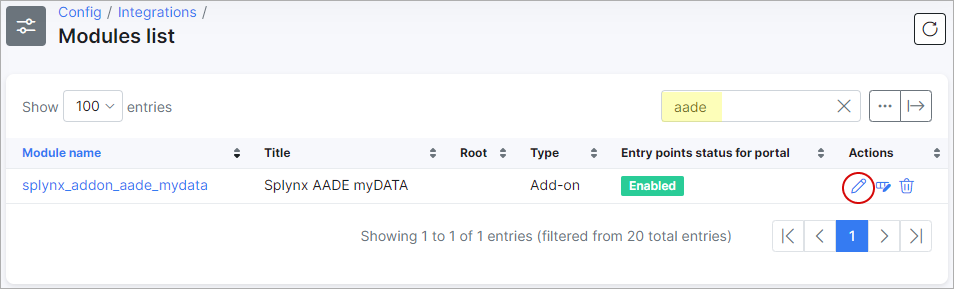

Once this done, navigate to Config → Integrations → Modules list for initial setup:

Then click on the Edit button under the module:

¶ Settings

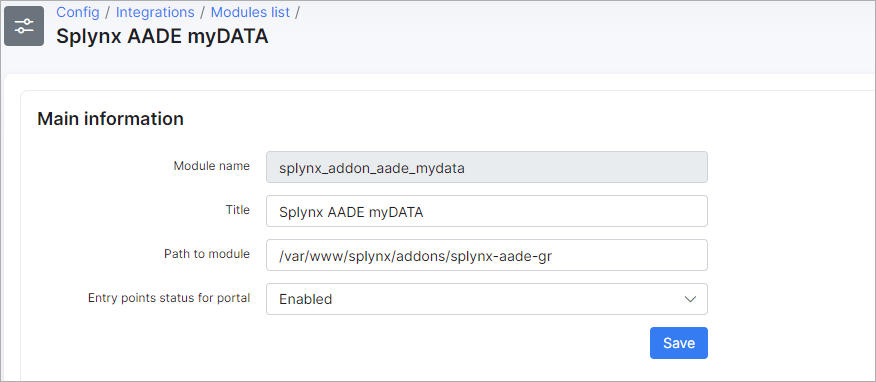

Here you should specify AADE myData API settings:

-

Username - registered aade-user-id;

-

Subscription key - Ocp-Apim-Subscription-Key.

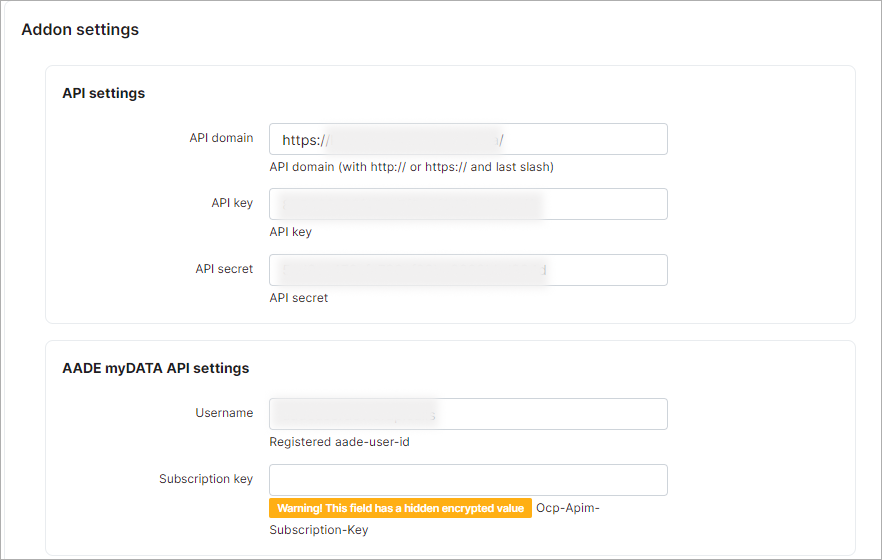

After that, you should configure synchronization settings:

-

Partners ignore list - select partners which will be ignored through synchronization process;

-

VAT number - specify your registered VAT number;

-

Issuer country -

GRfor Greece; -

Issuer branch - if the branch is headquarters or doesn't exist, the branch field must have a value of

0; -

Invoice series - mandatory for some invoice types (

Aby default); -

VAT Exemption Cause - exemption cause for items with

Without VATtax rate; -

Default counterpart country - counterpart country code to use by default (

GRby default); -

Default counterpart branch - counterpart branch to use by default (

0by default); -

Synchronize invoices by cron - enable/disable automatic synchronization of invoices.

¶ Configuring eInvoicing items

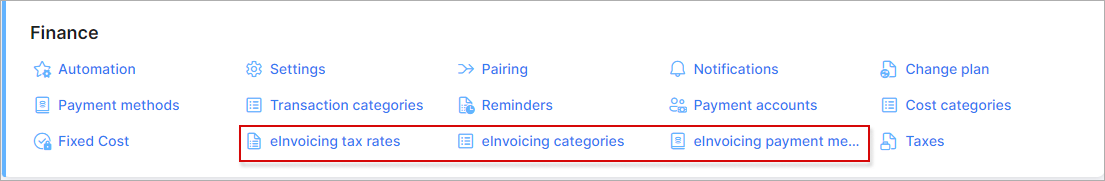

Once this done, you need to configure elnvoicing tax rates, invoicing categories and payment methods:

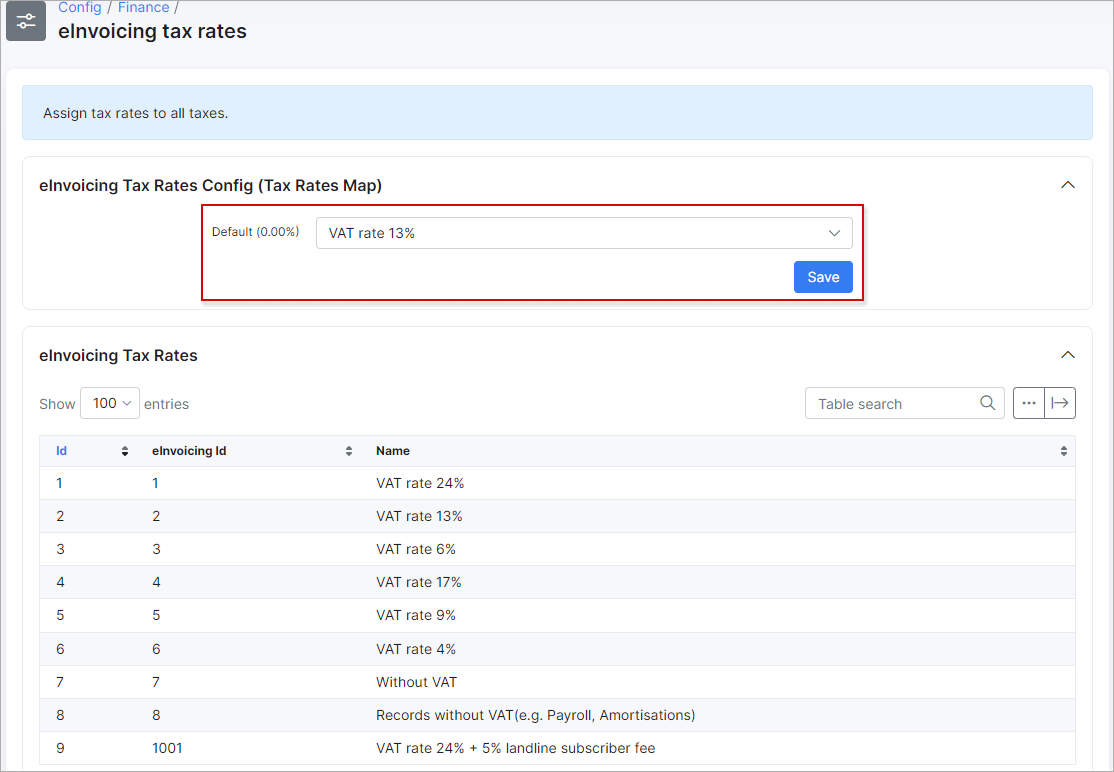

Let's start with tax rates configuration:

You need to pair existing TAX rates in Splynx with rates loaded from AADE.

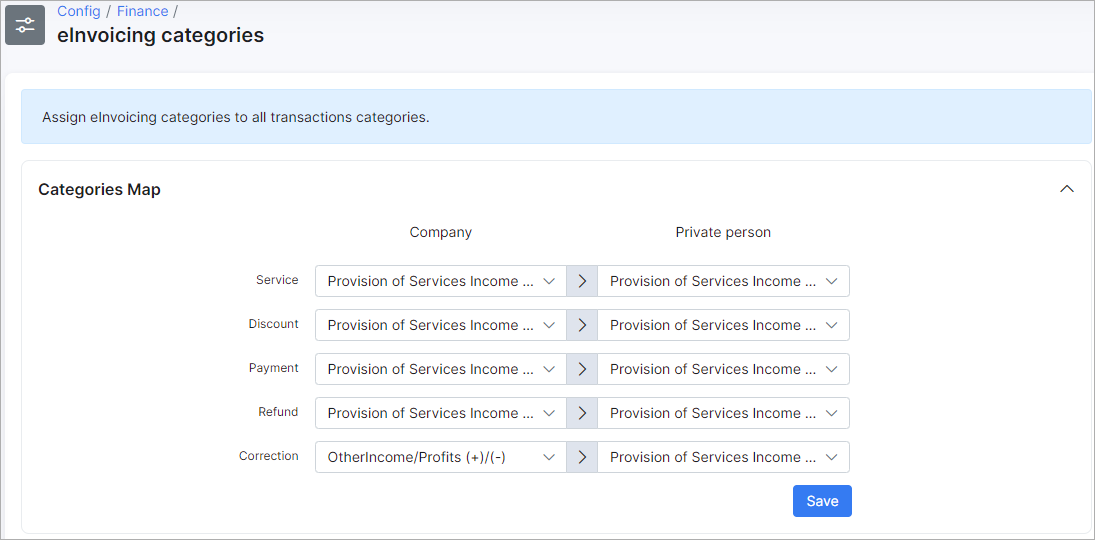

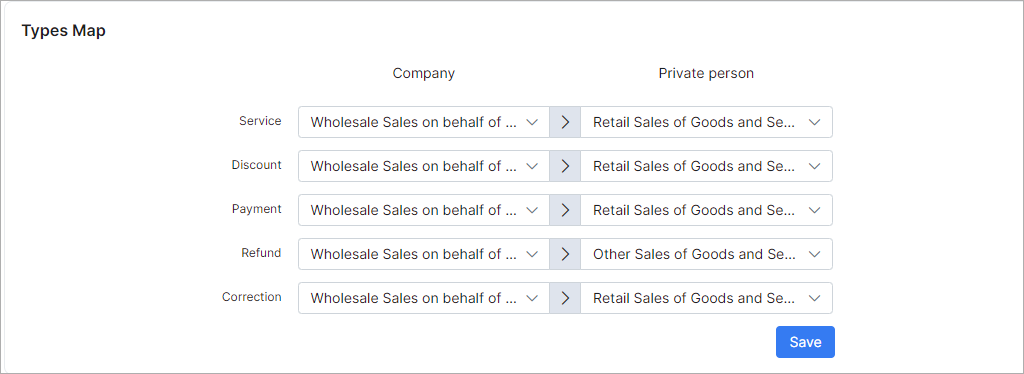

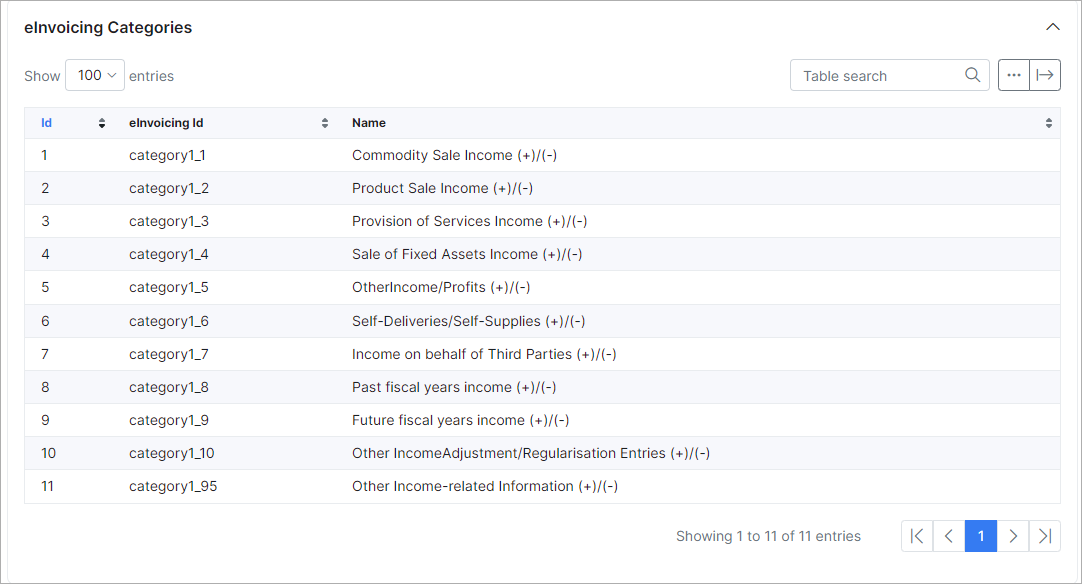

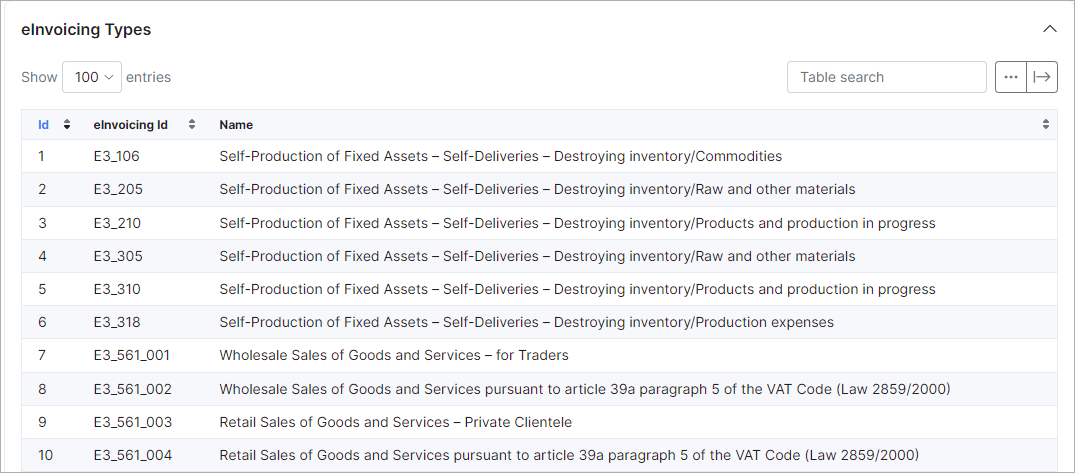

Then, please configure invoices categories:

In this form the categories and types of invoices should be mapped with the loaded categories and types from AADE:

¶ Mapping of payment methods

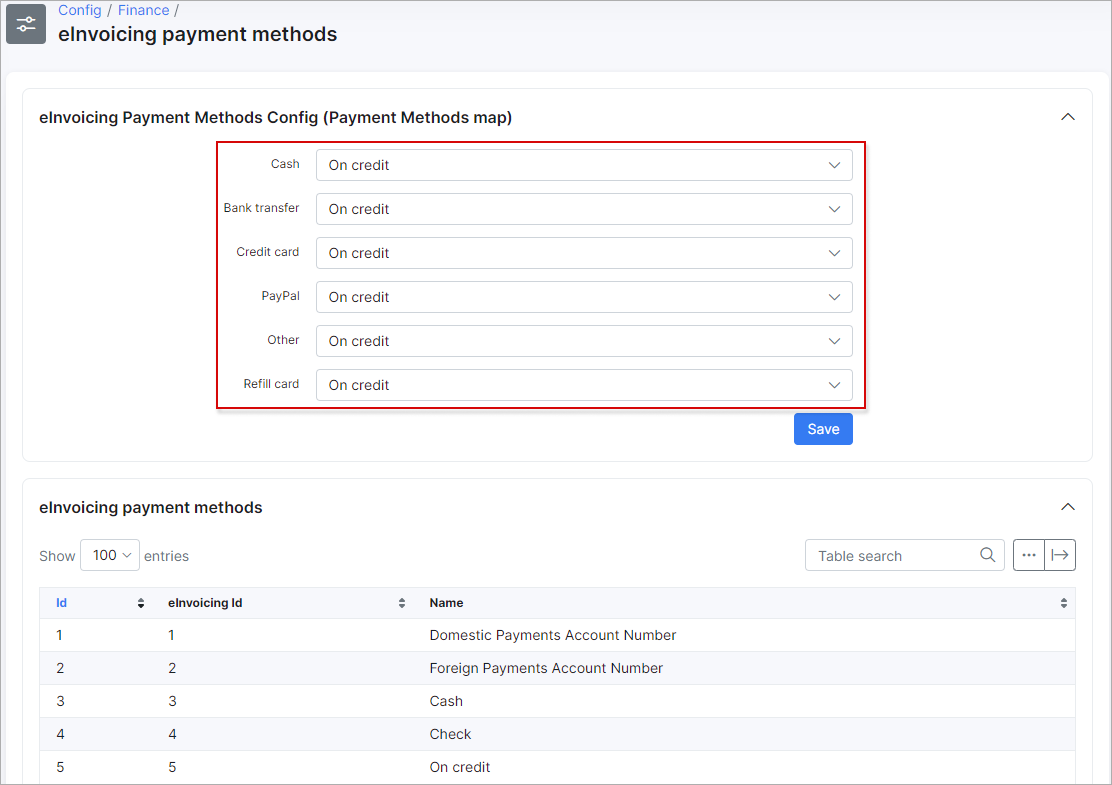

Once this done, you should configure mapping of payment methods:

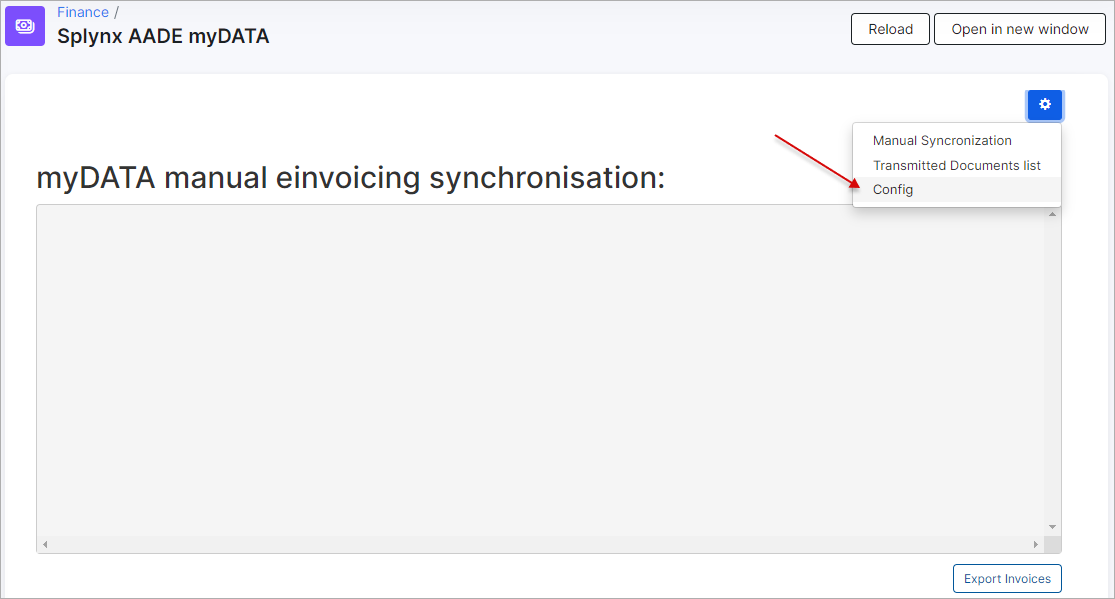

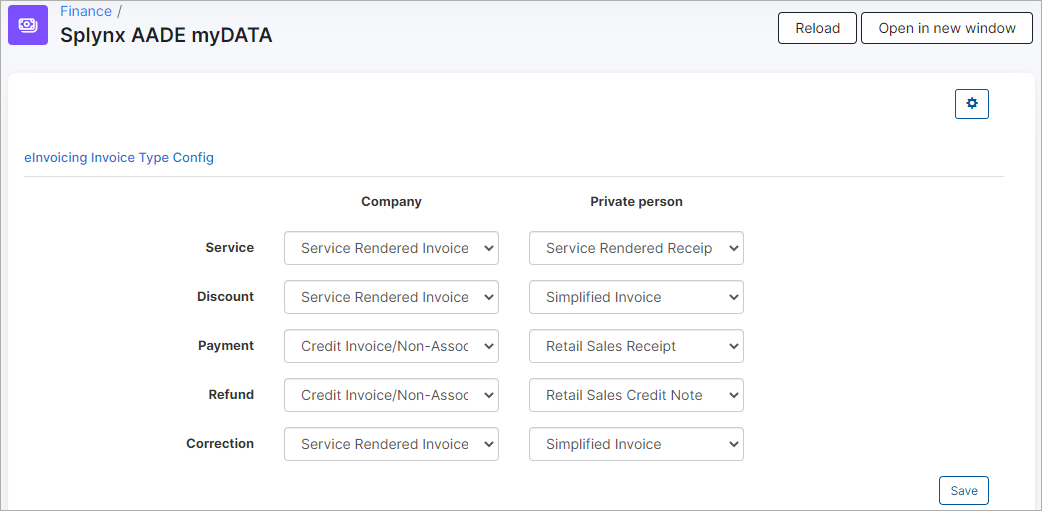

After that, there is one more place to update settings, it's under Finance → Splynx AADE myDATA:

These settings are individual and may differ for every company. Some types of invoices require a customer's VAT number (on a customer view under field VAT).

All types of invoices require a customer's VAT number, except : Retail Sales Receipt, Service Rendered Receipt, Simplified Invoice, Retail Sales Credit Note.

To find out how these categories and types should be configured, you can download a file that contains sheets for each invoice type: Download.

IMPORTANT - the invoice which contains positive (100) and negative (-100) items can't be synced to AADE. These items should be separated into different invoices.

IMPORTANT - the invoice which contains positive (100) and negative (-100) items can't be synced to AADE. These items should be separated into different invoices.

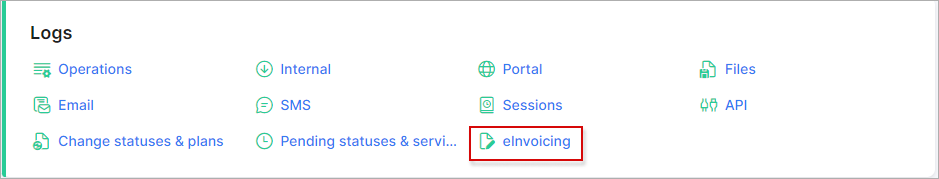

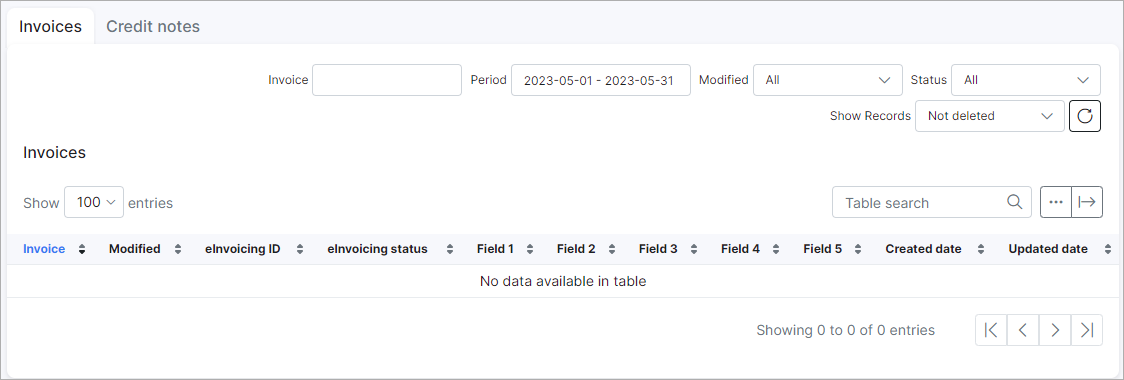

¶ Logs

To find the list of invoices that have been synchronized with AADE, navigate to Administration → Logs → eInvocing:

eInvoicing ID field contains the ID of the synced invoice/credit note. If this field is empty, it means that the invoice/credit note has not been synced.