¶ Tax update

¶ Overview

The Tax update feature provides a structured and efficient way to manage tax rate changes. Tax regulations can vary over time, and it's critical to apply the correct rates as of their effective dates to ensure compliance and accurate billing.

¶ Configuration

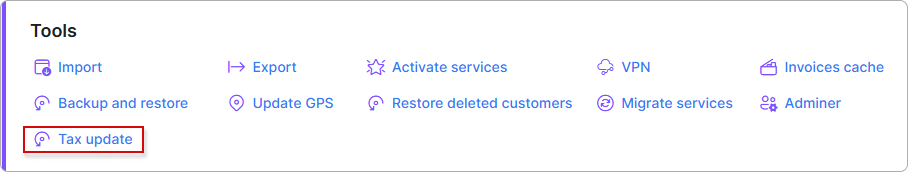

This feature supports the automation of mass tax changes on the specified due date, enabling administrators to apply new tax rates in the system as required.

Once updated, the new tax rates will be applied on the specified date across all relevant billing operations, ensuring consistency and compliance with tax regulations.

-

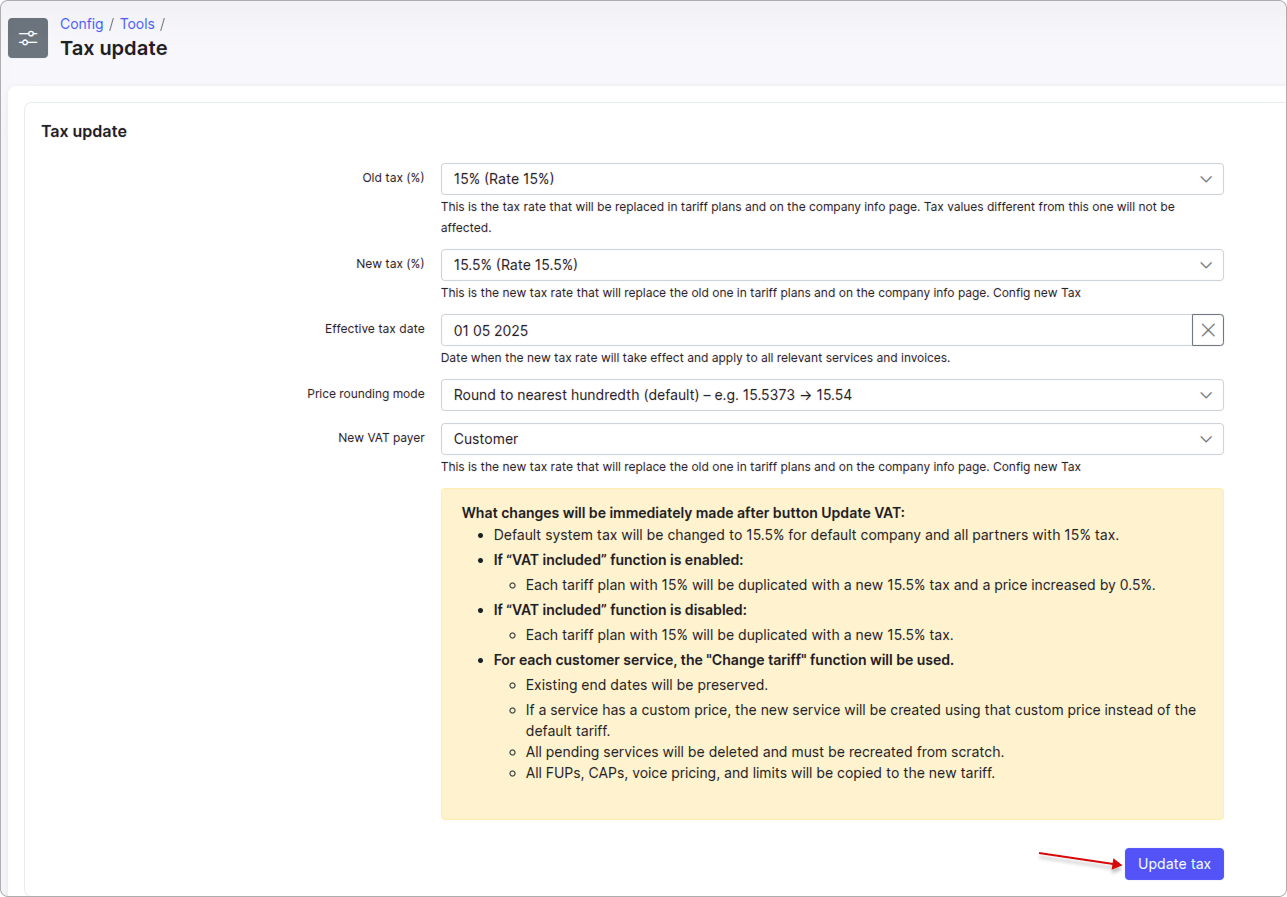

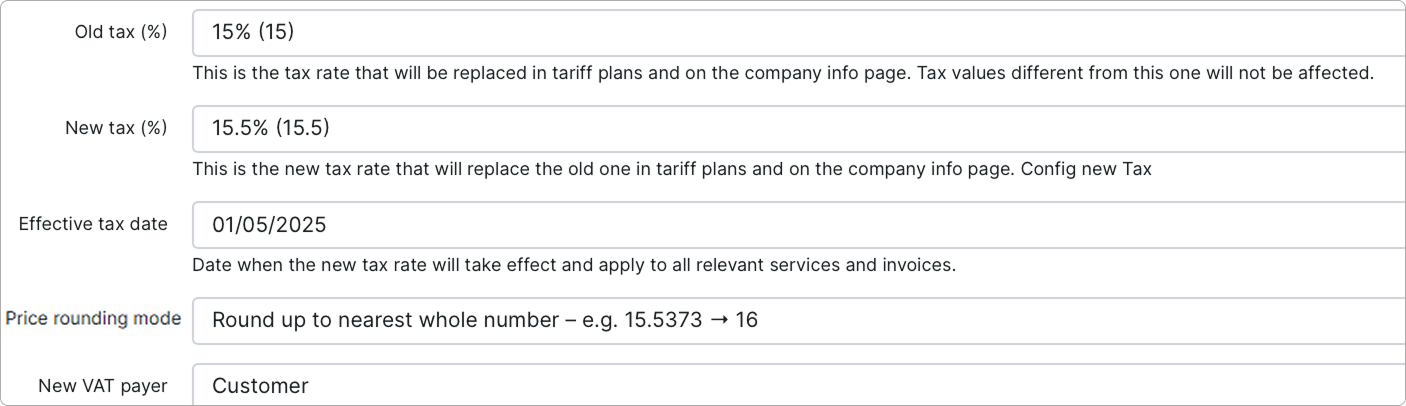

Old tax (%) - the tax rate that will be replaced in tariff plans and on the Company info page.

Tax values different from this one will not be affected.

Tax values different from this one will not be affected. -

New tax (%) - the new tax rate that will replace the old one in tariff plans and on the Company info page.

You can select the new tax only from the list of previously created taxes. For more details, please read Taxes.

You can select the new tax only from the list of previously created taxes. For more details, please read Taxes. -

Effective tax date - the date when the new tax rate takes effect and is applied to all relevant services and invoices.

-

Price rounding mode - choose how tax rates will be rounded:

Round to nearest hundredth (default) – e.g. 15.5373 → 15.54

Round up to nearest whole number – e.g. 15.5373 → 16

Round up to nearest tenth – e.g. 15.5373 → 20

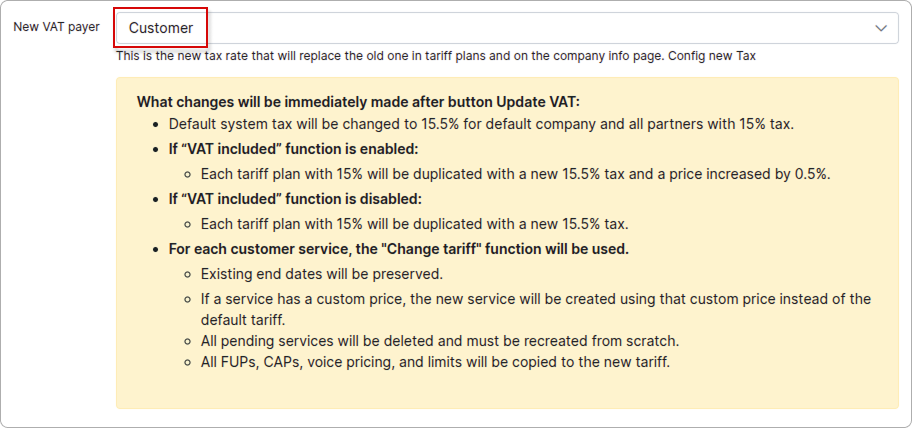

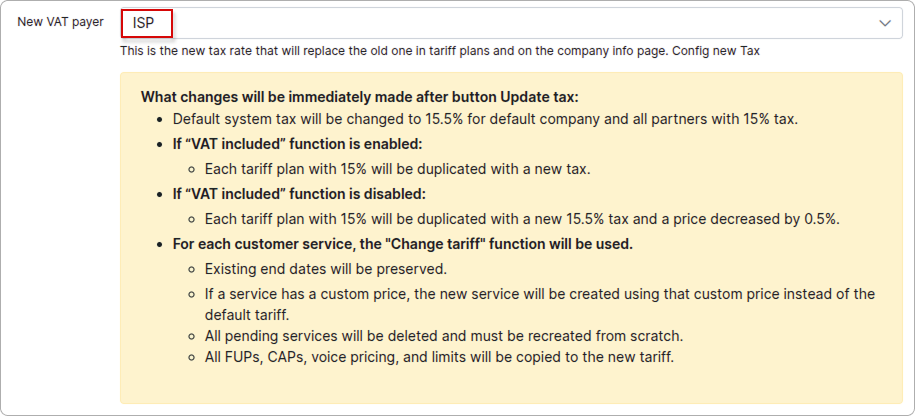

- New VAT payer - select the entity (Customer or ISP) responsible for paying the new VAT:

Some changes will take effect immediately after the tax rate is updated and will depend on the type of VAT payer.

Customer:

ISP:

After configuring the changes, click the Update tax button.

Only Super administrators can update taxes by default.

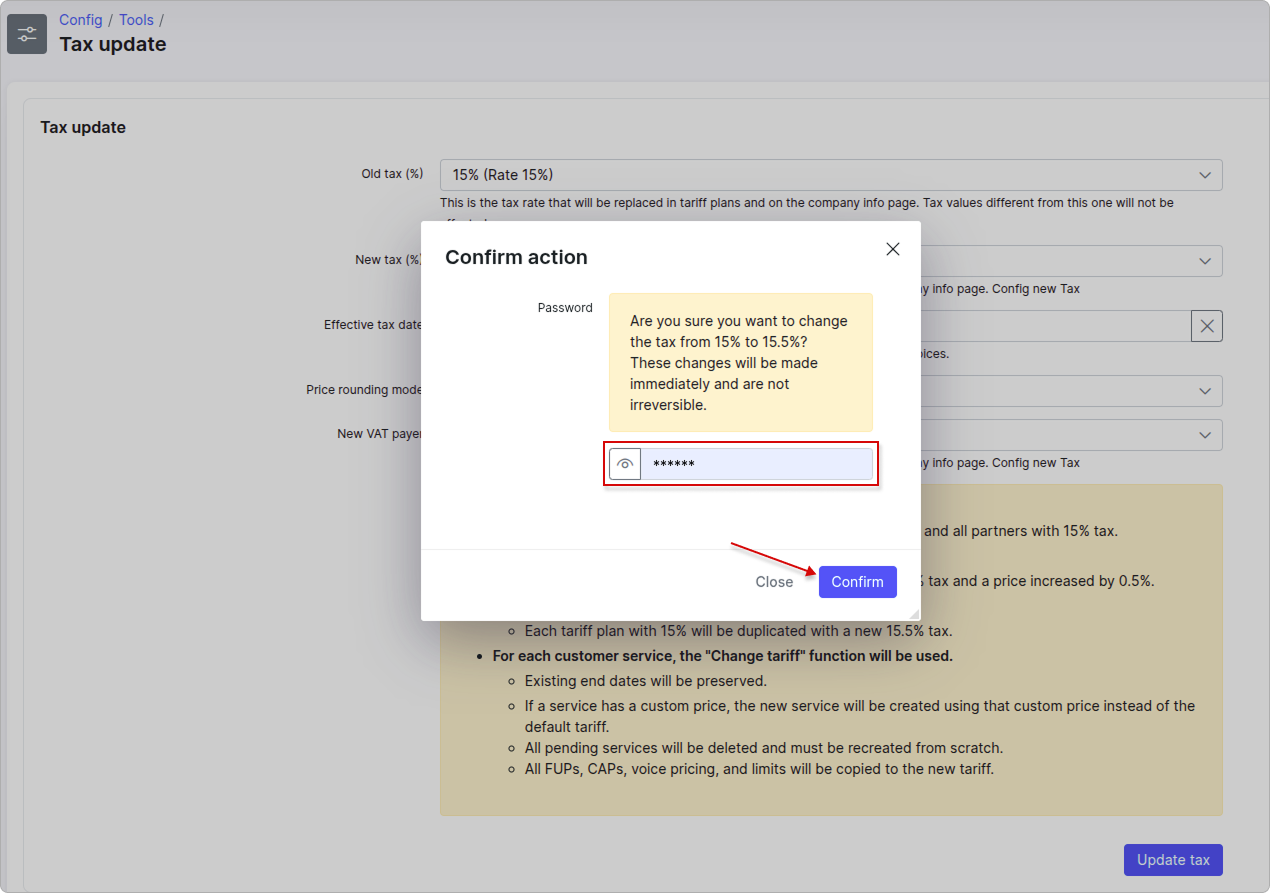

You'll need to enter your password and click Confirm to proceed with the update, as these changes are irreversible:

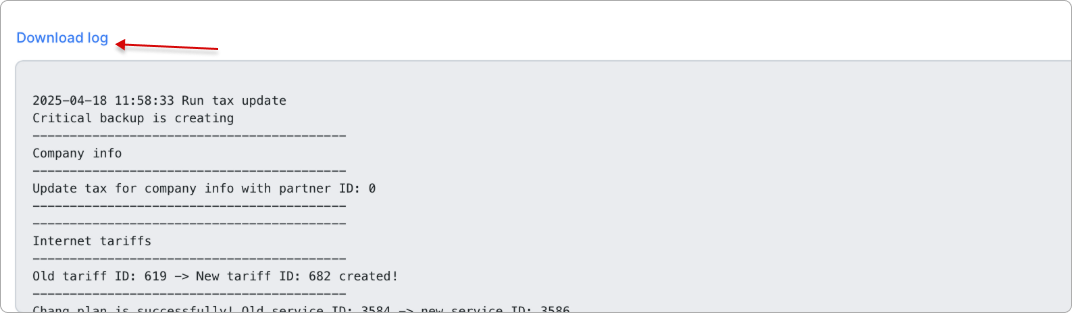

When the update starts, a progress log will appear below and can also be downloaded:

Some changes will be applied immediately, while others will take effect on the specified date.

Some changes will be applied immediately, while others will take effect on the specified date.

The linkage between newly created tax rates and any connected accounting add-ons must be configured manually. It is the responsibility of system administrators to complete this step to ensure proper tax data synchronization and reporting.

¶ How it works

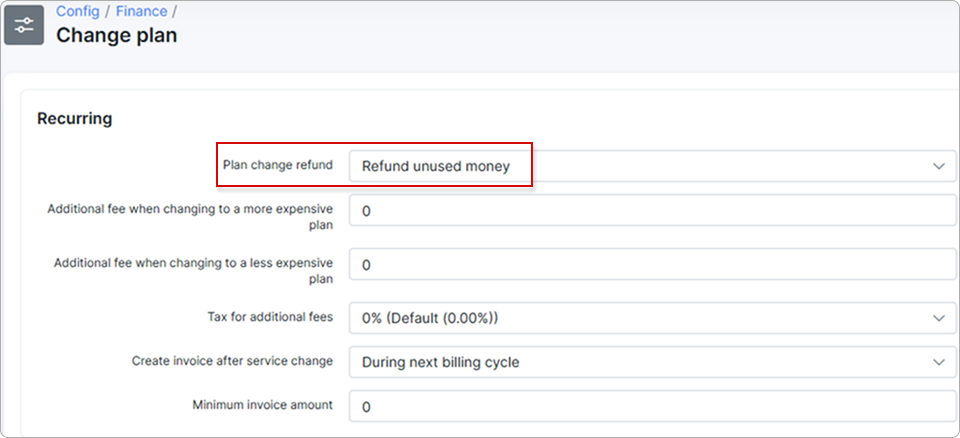

First, enable the Refund of unused money option before applying the updated tax rate to the customer's tariffs:

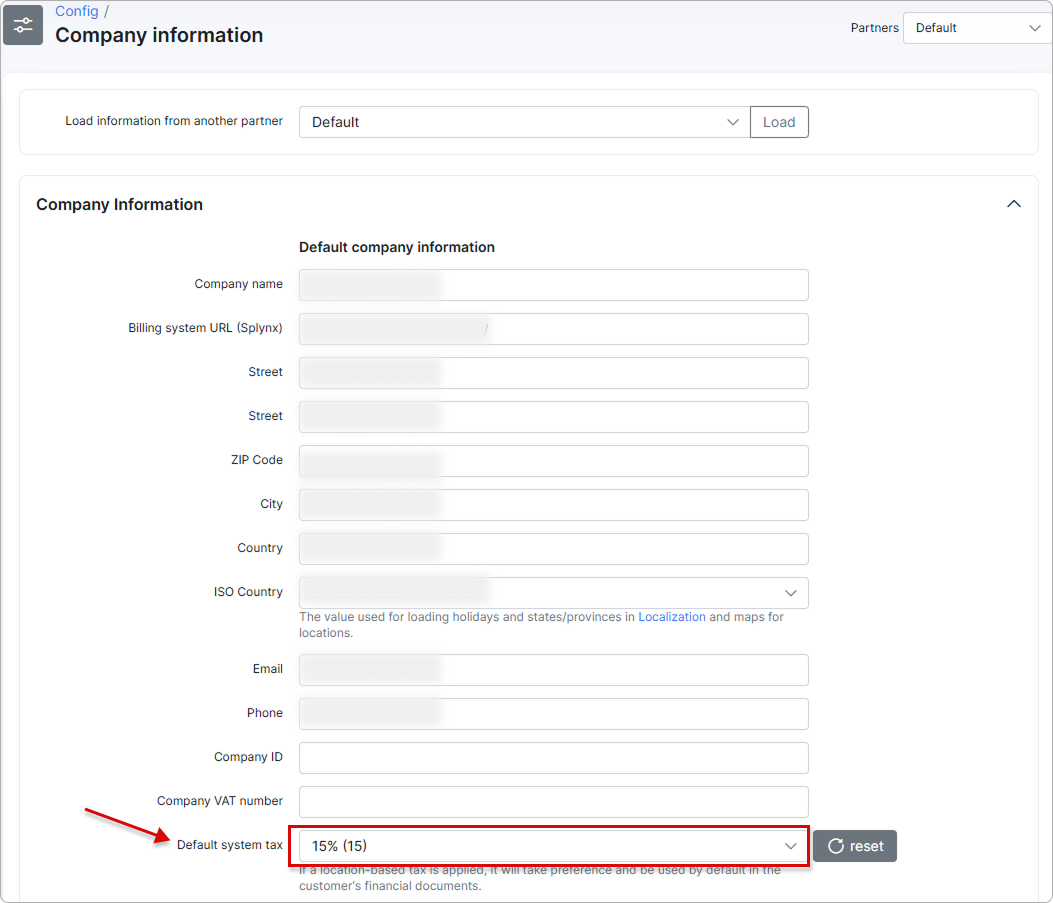

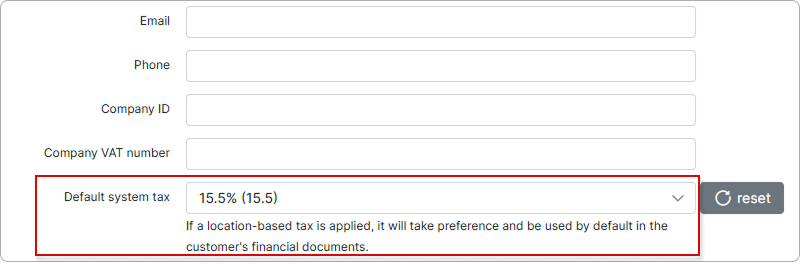

For example, in Config → System → Company Information, the default system tax is set to 15%.

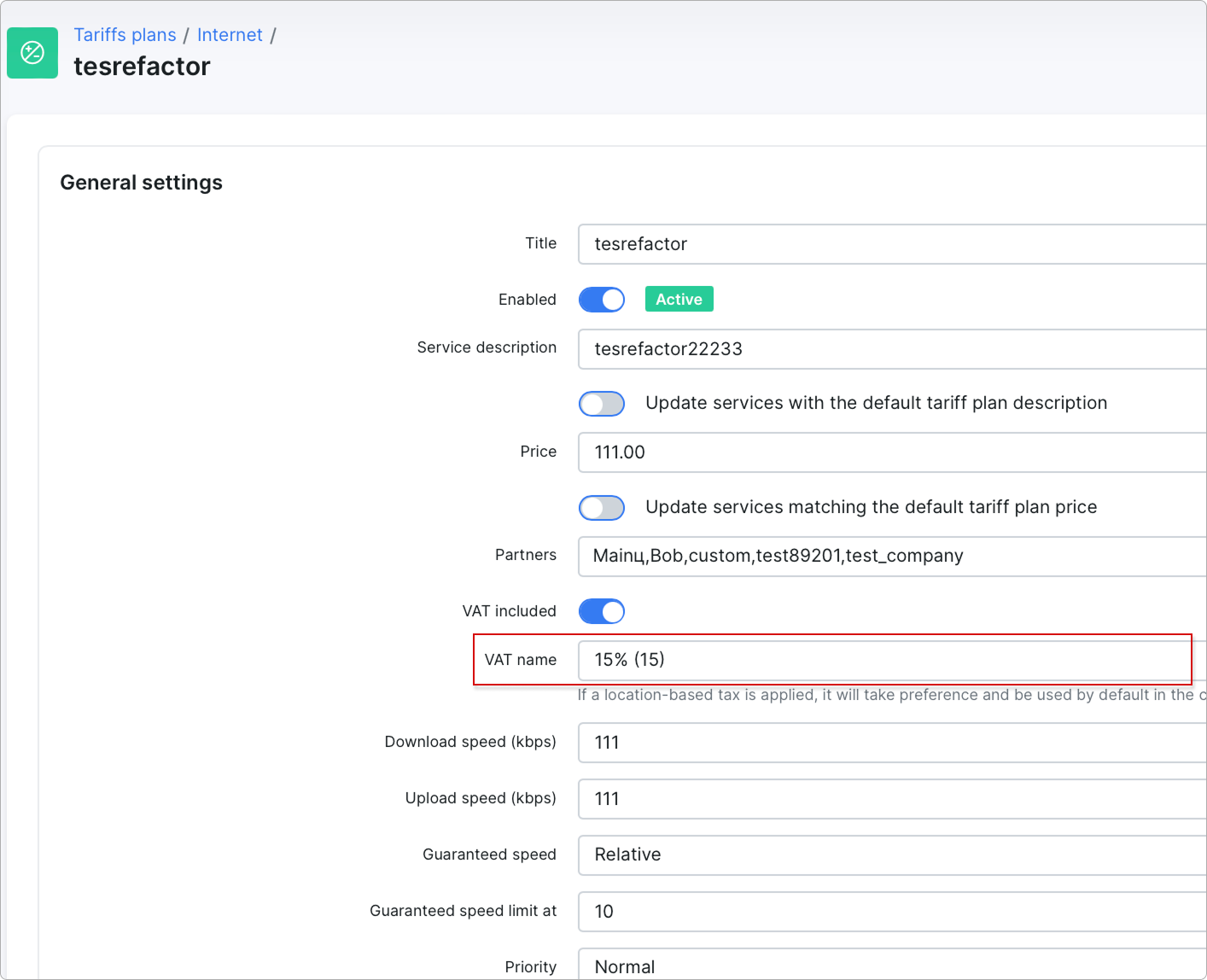

Let’s create a tariff plan using the default tax rate:

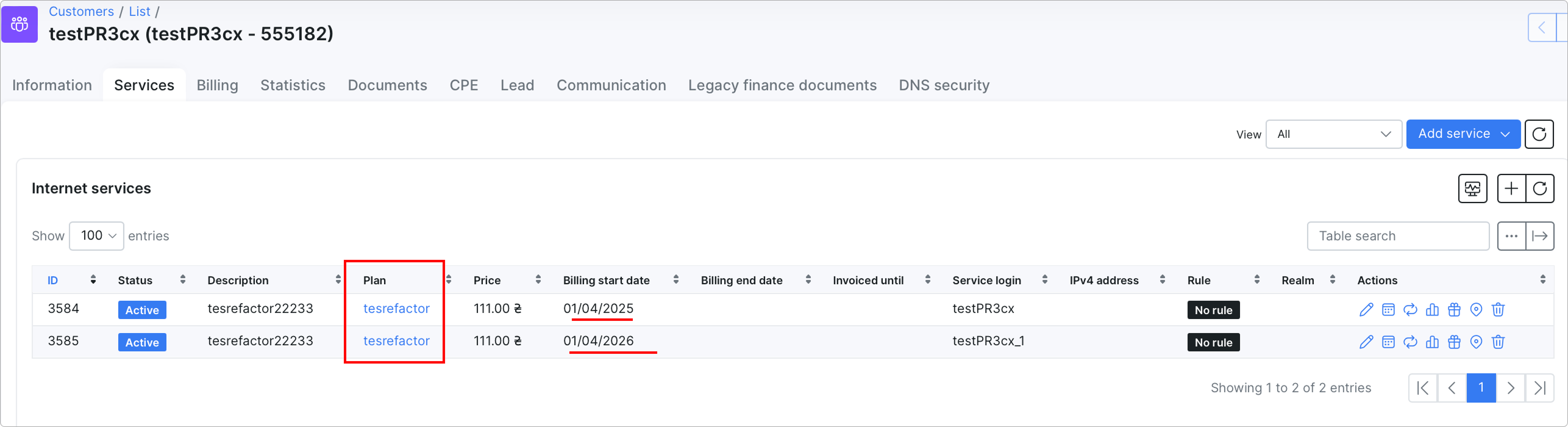

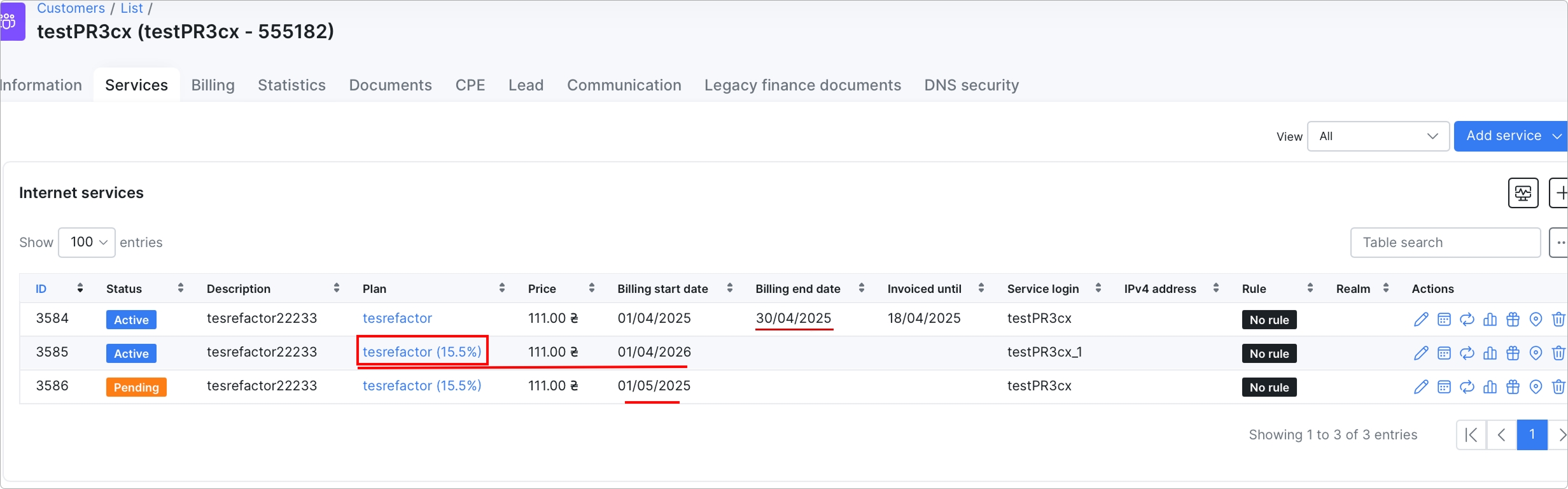

For example, we assign this tariff plan with the default tax rate to the customer, using different billing start dates: one at the beginning of the month and another on the same month of the following year:

Then, we go to Config → Tools → Tax update and apply the following configuration:

After this, the default tax under Company information changes to 15.5% for all partners with the same tax rate, as specified in the configuration:

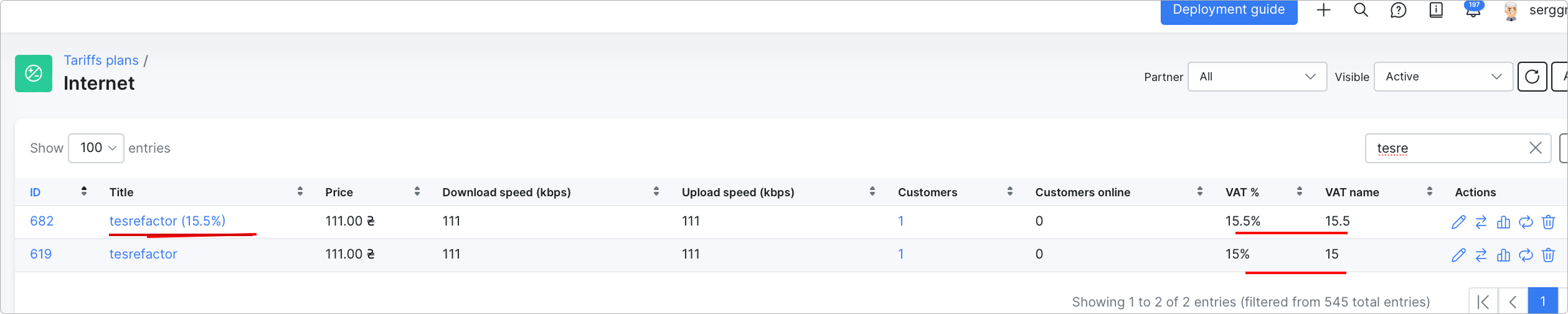

In Tariff plans, a duplicate tariff will be created with the new tax rate:

When we return to the customer's tariffs, we can see that the service with the new tax rate was automatically added with Pending status because the plan change occurred.

However, for the service in the following year, only the tariff was updated, and the new tax rate was applied immediately:

¶ Restoring backup

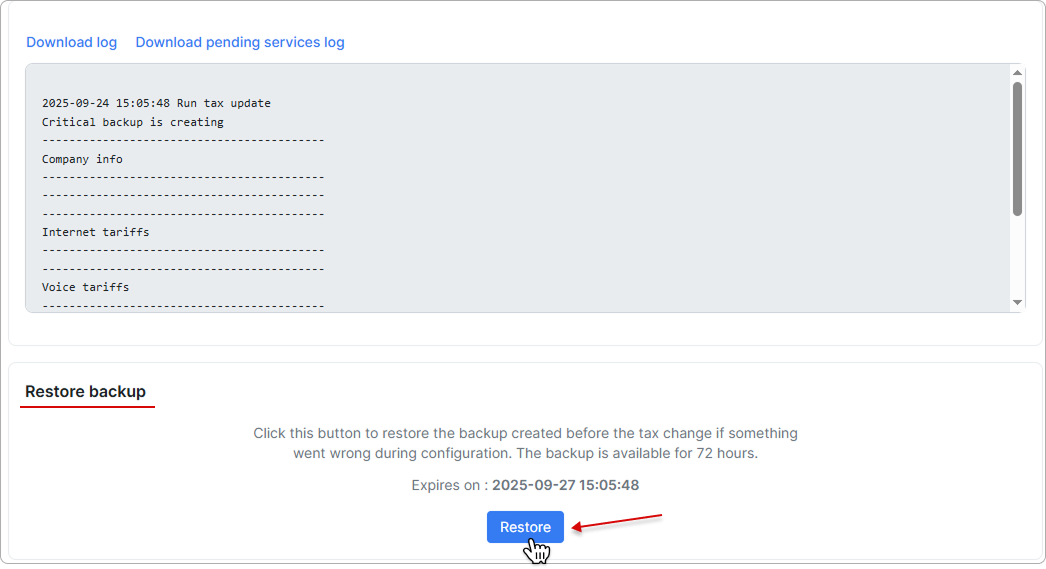

If something goes wrong after the tax update, you can reverse the action using the Restore backup feature.

The backup will be available for 72 hours.

After completing the tax update, reload the page. A new Restore backup section will appear under the tax update information. This section shows when the backup will expire.

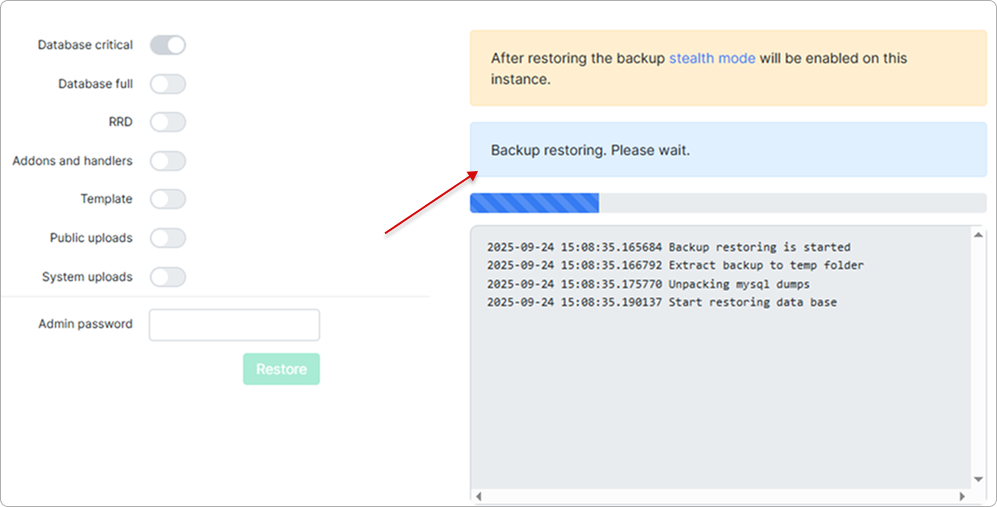

Click Restore to start the process:

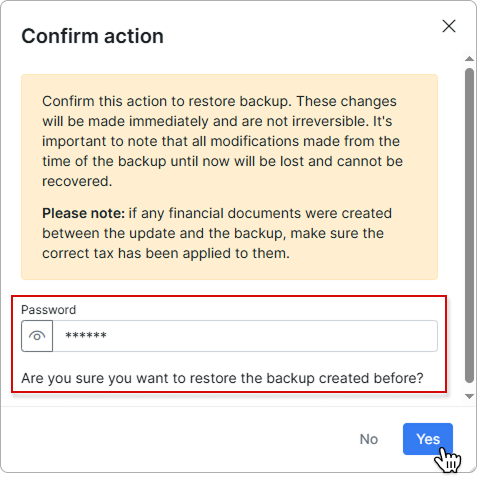

Enter your password in the new window to confirm the action, then click Yes.

All changes made since the backup will be lost and cannot be recovered.

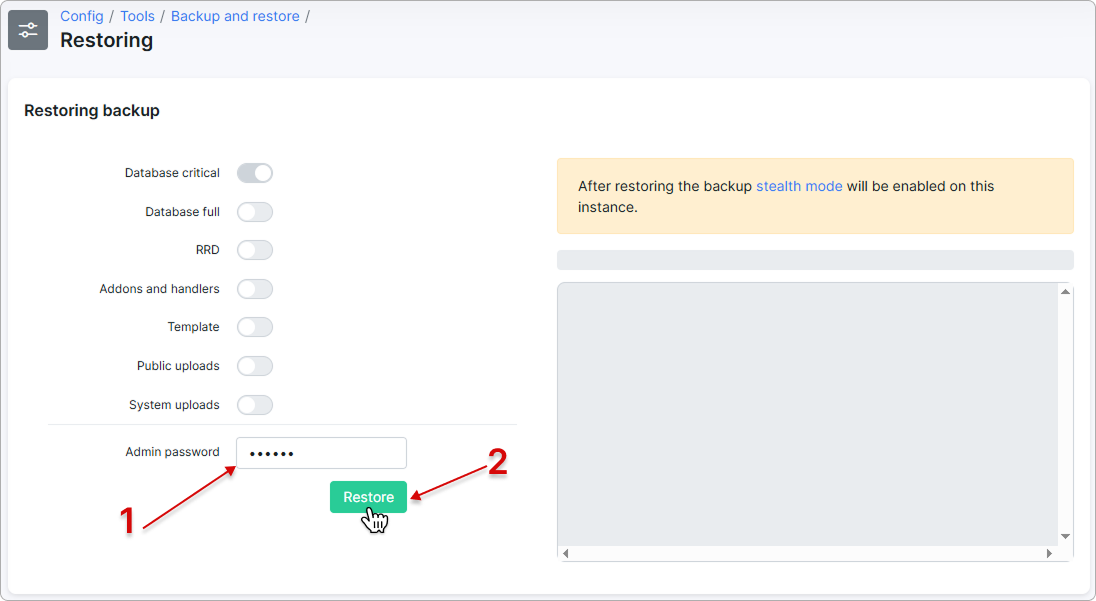

On the new page, enter your password again, then click Restore:

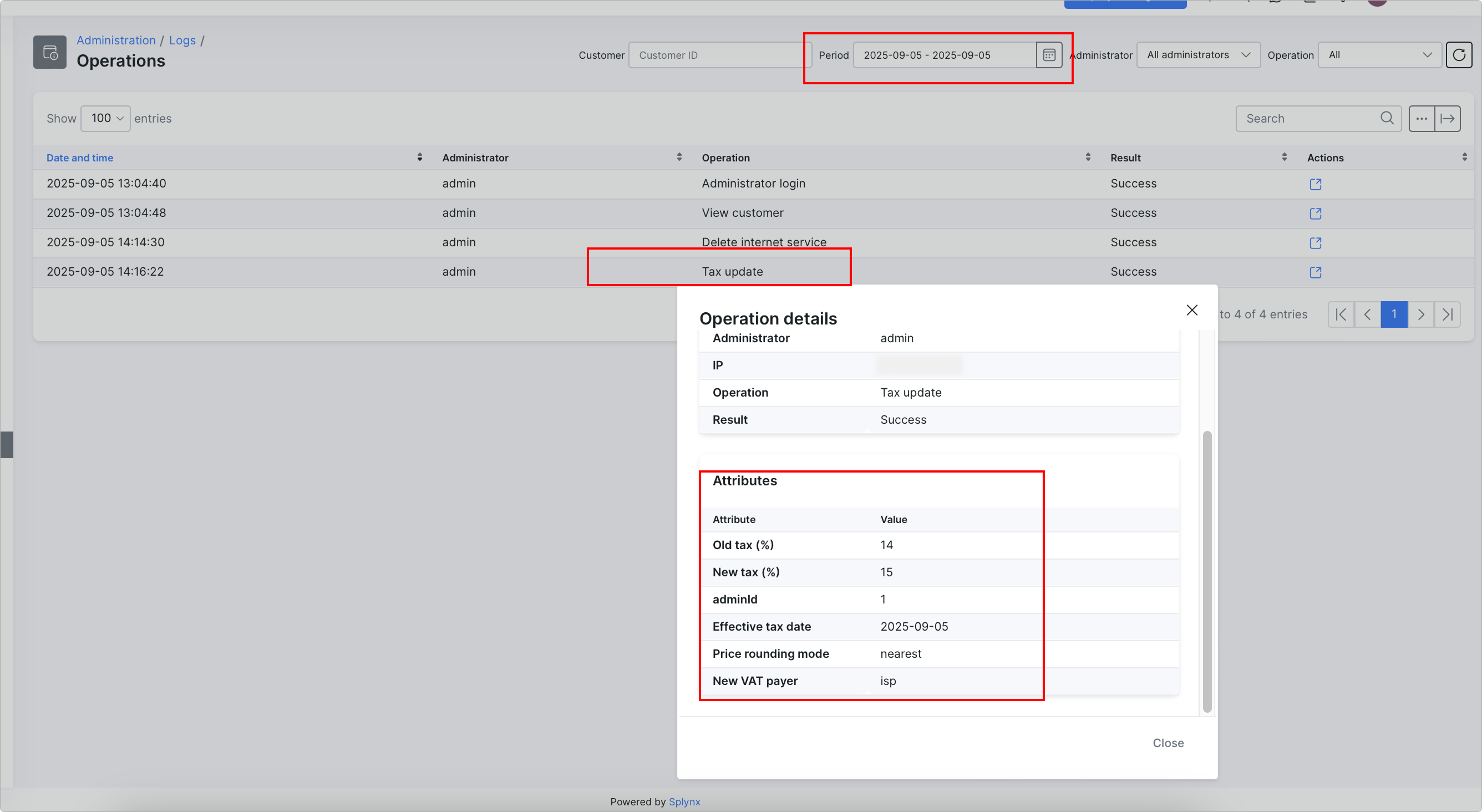

You can find information about the completed backup restore in the Operations logs: