¶ Tax summary

¶ Tax report tab

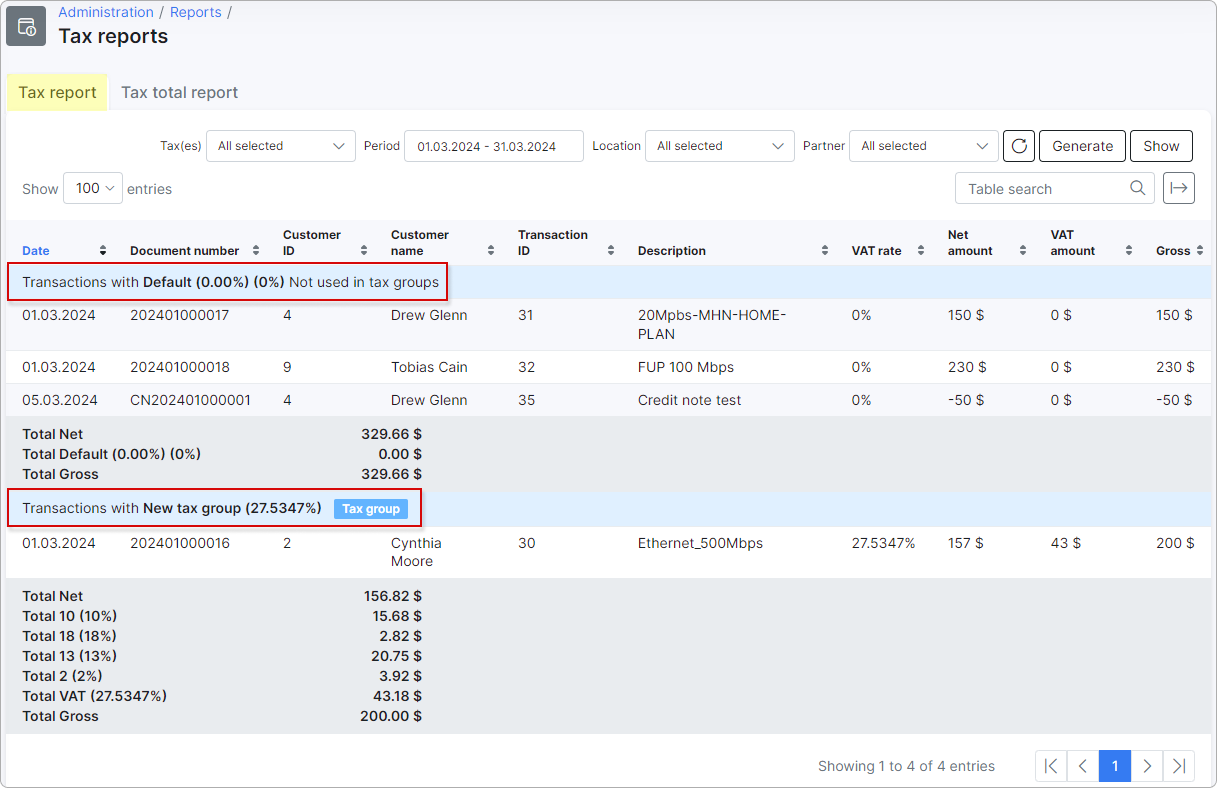

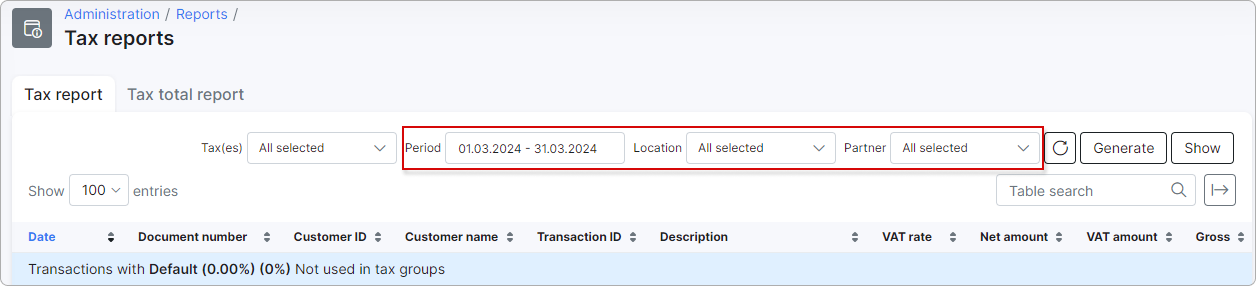

To view a detailed report of customers associated with a specific tax or tax group, simply navigate to the Tax Report tab. The report will be presented in a table format, grouping customers by the relevant tax rates/tax groups recorded in the system.

Please read about Tax groups to learn more.

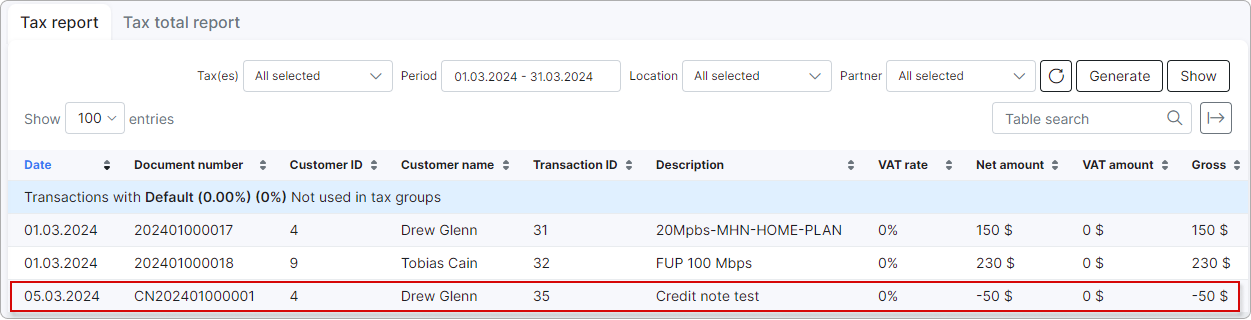

In the report, you'll be able to see customer details, such as their name and ID. Additionally, you will find information relevant to the specific document, including its issue date, document number, transaction ID, description (indicating the service for which the document was issued), applicable VAT rate (tax percentage), net amount (sum of the service cost), VAT amount (tax sum), and gross amount (total sum: net amount + VAT amount).

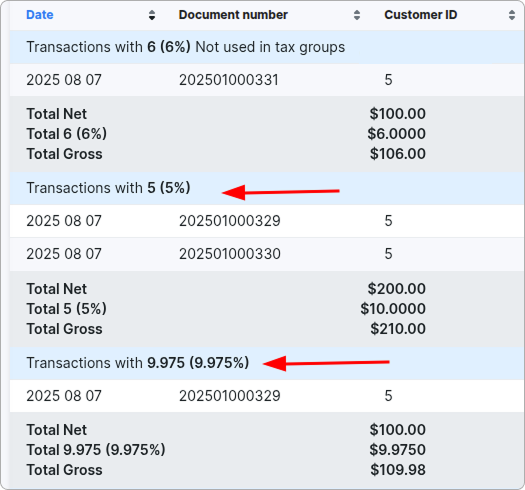

For your convenience, the report data is shown for each tax rate/tax group separately:

You can view each tax within a tax group separately. Such a tax rate will not have a label or note next to it:

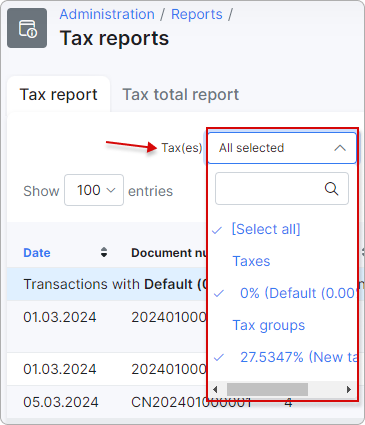

You can filter the data to show specific taxes or tax groups:

Credit notes are represented as a negative value:

Credit notes are represented as a negative value:

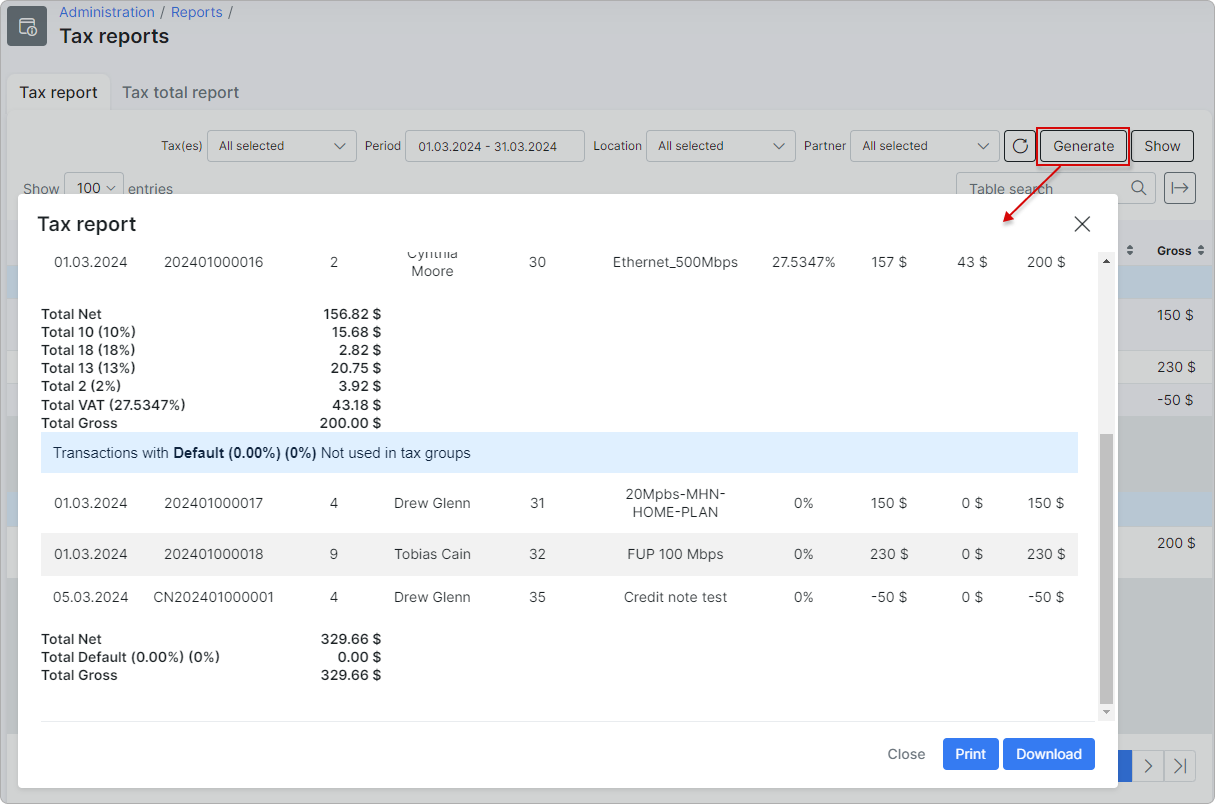

¶ Generate report

To generate a report with the presented data, click the Generate button. You can then choose to print the report or download it in HTML format:

¶ Tax total report tab

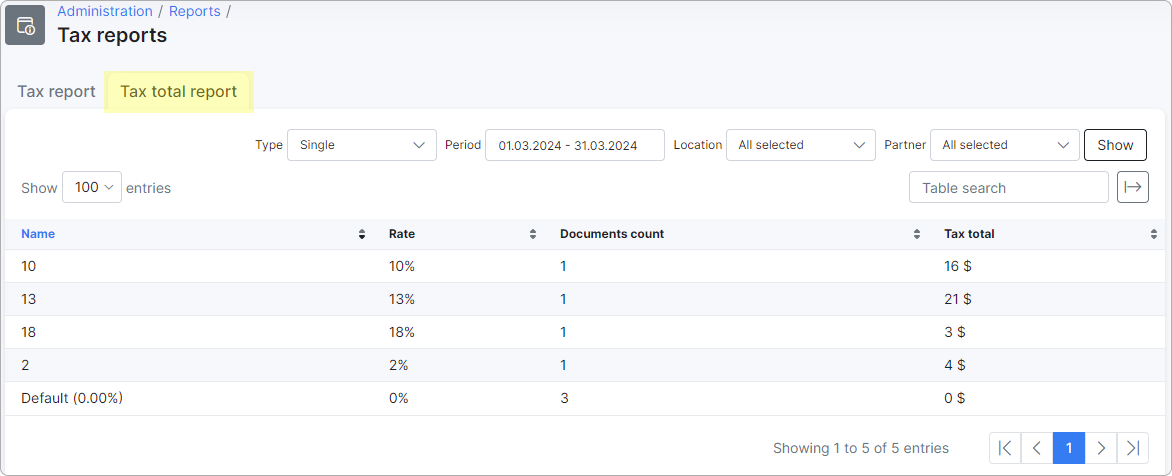

In the Tax total report tab, you can view every tax used in the documents for the selected period, along with its name and rate. Additionally, the total count of documents and the overall tax total are displayed.

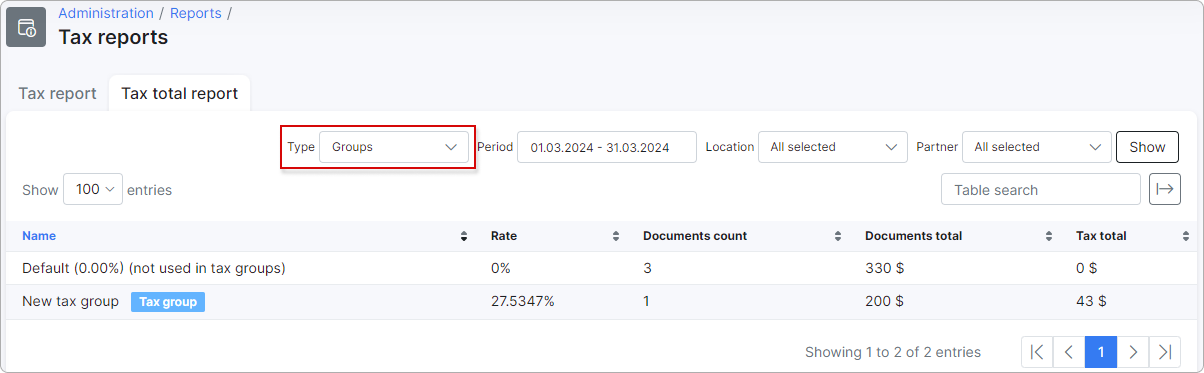

To view taxes by group, choose Groups in the Type drop-down menu:

¶ Data filtering

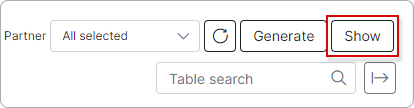

It is possible to filter the report by Period, Location, or Partner:

Click on

Showeach time you want to view the updated/filtered data:

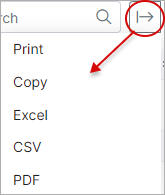

¶ Table management and data export

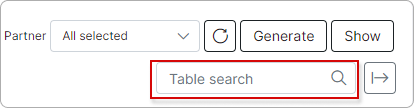

With the help of the search bar, you can search for specific data within the table:

The table can be exported in a format of your choice using one of the available methods. You can do this by clicking on the export icon, which is located at the top right of the table: